About us

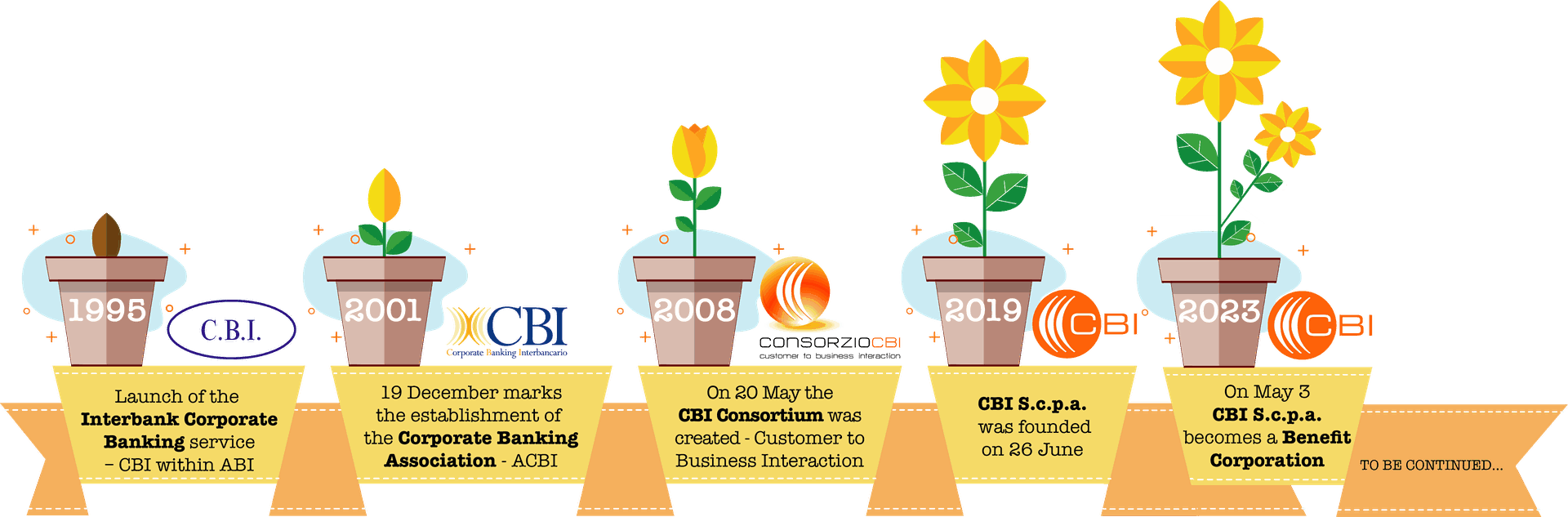

On May 3, 2023, the General Shareholders' Assembly of CBI S.c.p.a. approved the evolution of CBI into a Benefit Corporation. In this regard, a Press Release was released, that can be consulted at this LINK.

CBI S.c.p.a. Benefit Corporation is a public limited consortium company, comprising 400 banks and other intermediaries as shareholders, that develops infrastructures, innovative services and ecosystems for the financial and banking industry, supporting digital payments, open banking and open finance; services that CBI customers, banks and fintechs, ultimately extend to a wide set of clients, responding efficiently and effectively to the needs of business, Public Administrations and citizens in an increasingly competitive market.

CBI operates under the supervision of Bank of Italy persuant to Article 146 T.U.B. and therefore obligated to comply with the measure "Provisions on the supervision of payment systems and technological or network instrumental infrastructure" of November 9, 2021 as a "Critical infrastructure or service provider".

Since the 1990s, the Italian banking sector, under the leadership of the Associazione Bancaria Italiana - ABI (Italian Banking Association), has been a pioneer in the process of creating interbank ecosystems. CBI is a tangible and rewarding testament to this, still driving innovation and the creation of collaborative ecosystems in response to the ever faster and more competitive demands of the payments market.

The creation of interbank ecosystems promotes innovation, by sharing rules, standards and common business models in self-regulation, to ensure reachability and interoperability among all of the players in the ecosystem. This allows each player in the ecosystem to use the shared, efficient and reliable infrastructure and to offer their customers a high added-value service on a competitive basis, while reducing operating costs.

Based on these guidelines, in 1995 ABI and the relevant commercial banks set up the first interbank agreements to develop the CBI Service for Interbank Corporate Banking. This led to establishing the Association for Interbank Corporate Banking (ACBI) on 19 December 2001, which was followed on 28 May 2008 by Consorzio CBI - Customer to Business Interaction, becoming CBI S.c.p.a. on 26 June 2019.

In order to respond to the changing market scenario, in recent years CBI has always developed service standards and technological infrastructure according to a collaborative logic, to bring together all of the players in the financial ecosystem at a domestic and international level. Payment services and digital information, designed by CBI and offered individually by banks and other intermediaries, make life easier for citizens and companies and facilitate access to PA.

Furthermore, CBI is “green by design”: digitising processes and reporting systems has always been at our core, making us eco-compliant by nature.

WATCH THE VIDEO

You might also be interested in

FINTECH

SERVICES

PSPs

PA

CORPORATES

TECHNICAL PROVIDERS

Energy saving

This screen allows your monitor to consume less power when the computer is idle

To resume browsing, just click anywhere on the screen